Note: If you’re reading this in the 2018 holiday season, use code “WHYITS60” to get The Public Radio for its mid-2017 price of $39. Happy holidays :)

Recently The Public Radio, the FM radio that I co-created, rather unceremoniously instituted a 33% retail price hike. It was a tough decision to make, and one that felt both like a capitulation and an experiment. It came about four and a half years after we first launched the product, and about a year after we relaunched it with the intention of building a sustainable, US-based supply chain. In other words, it was pretty late in the product’s life cycle to be making such a drastic change - something I thought a lot about.

For those who haven’t fully thought through what it would mean to manufacture consumer electronics in the US - and for those who’ve idly contended that we live in an age of mass customization - I offer my experiences.

How our supply chain works

Like all consumer electronics, many of the components (microprocessors, passives, electro-mechanical components) in The Public Radio are either only made in China or simply not practical to purchase from the US. For instance, the FM receiver module we use is marketed by a US company (Silicon Labs) but made in China, and even the worlds largest electronics brands would have little power to change that. Similarly our speaker could theoretically be made in the US, but to do so would effectively kill our cost structure, probably moving the radio’s retail price well above $100 from an already expensive $60.

As a result, there are only a handful of physical components which we source from the US: The mason jar that the radio is housed in (purchased from Newell Brands, which has a license on the iconic Ball jar product line) and our custom cardboard box, which is only cost effective when purchased within ~100 miles of where the radio’s final assembly occurs. We’ve seriously considered changing jars to a Chinese made version, which would probably result in a 50% price cut on that component, but the scale of our production didn’t warrant it. And besides, being able to order a few thousand jars at a time is quite appealing in contrast to the 10-20,000 unit orders that an overseas supplier would require.

Our assembly labor, however, is in the US and accounts for roughly half of our cost of goods sold. Our excellent assembly partner (Worthington Assembly) produces printed circuit board assemblies in batches of 324 (36 panels of 9 PCBs each; this number ends up working nicely with the trays we store the radios in). They then use those PCBAs, plus three mechanical components which we supply them with, to create mechanical assemblies which sit in inventory until a customer places an order. At that point a mechanical assembly is taken off of a shelf and programmed to the FM frequency the customer requested. It undergoes a full functional test and is put in the mail - typically less than a day after an order is placed. See this blog post for a more detailed description.

In other words: We’re making a piece of consumer electronics just-in-time in the US.

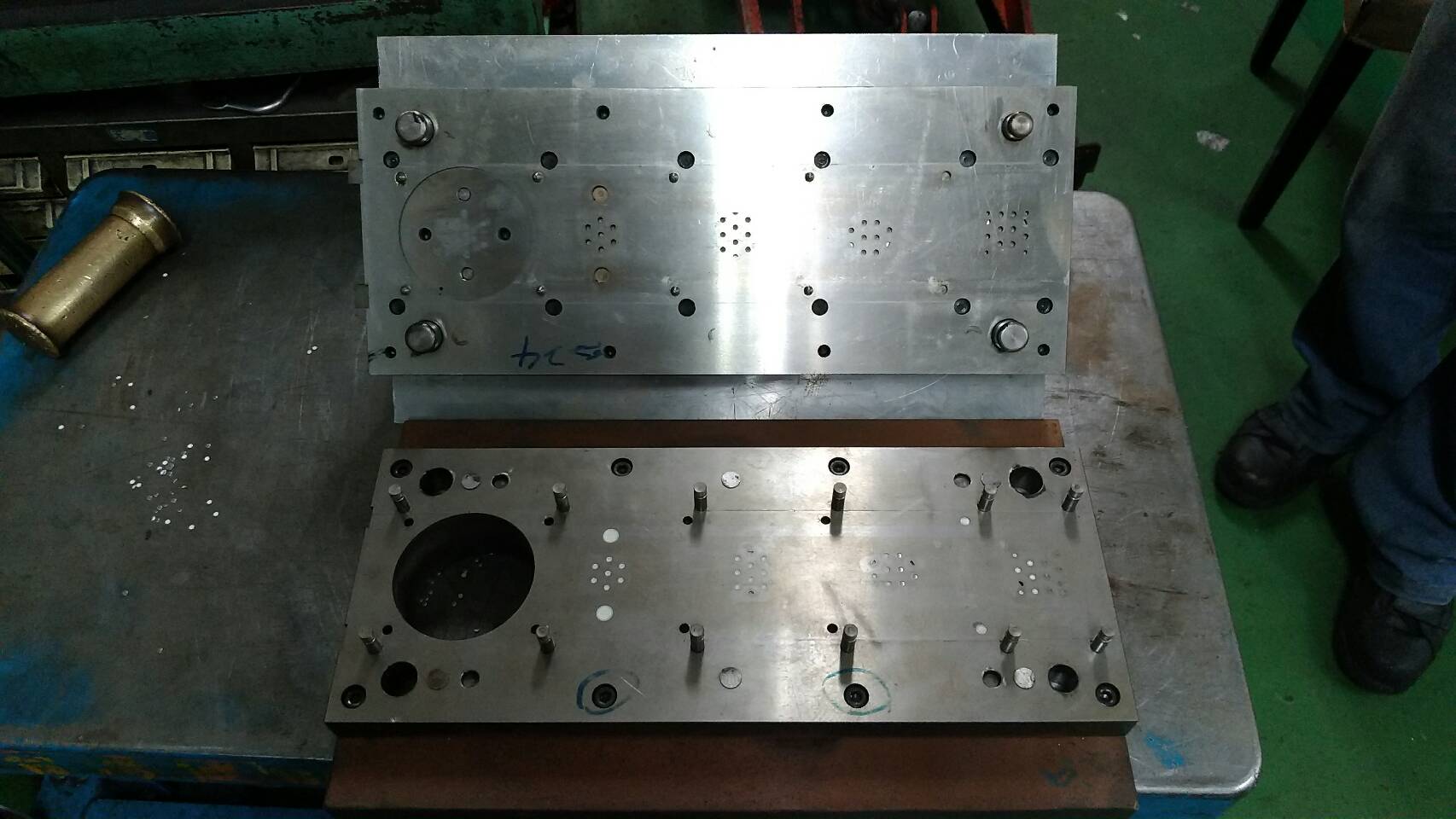

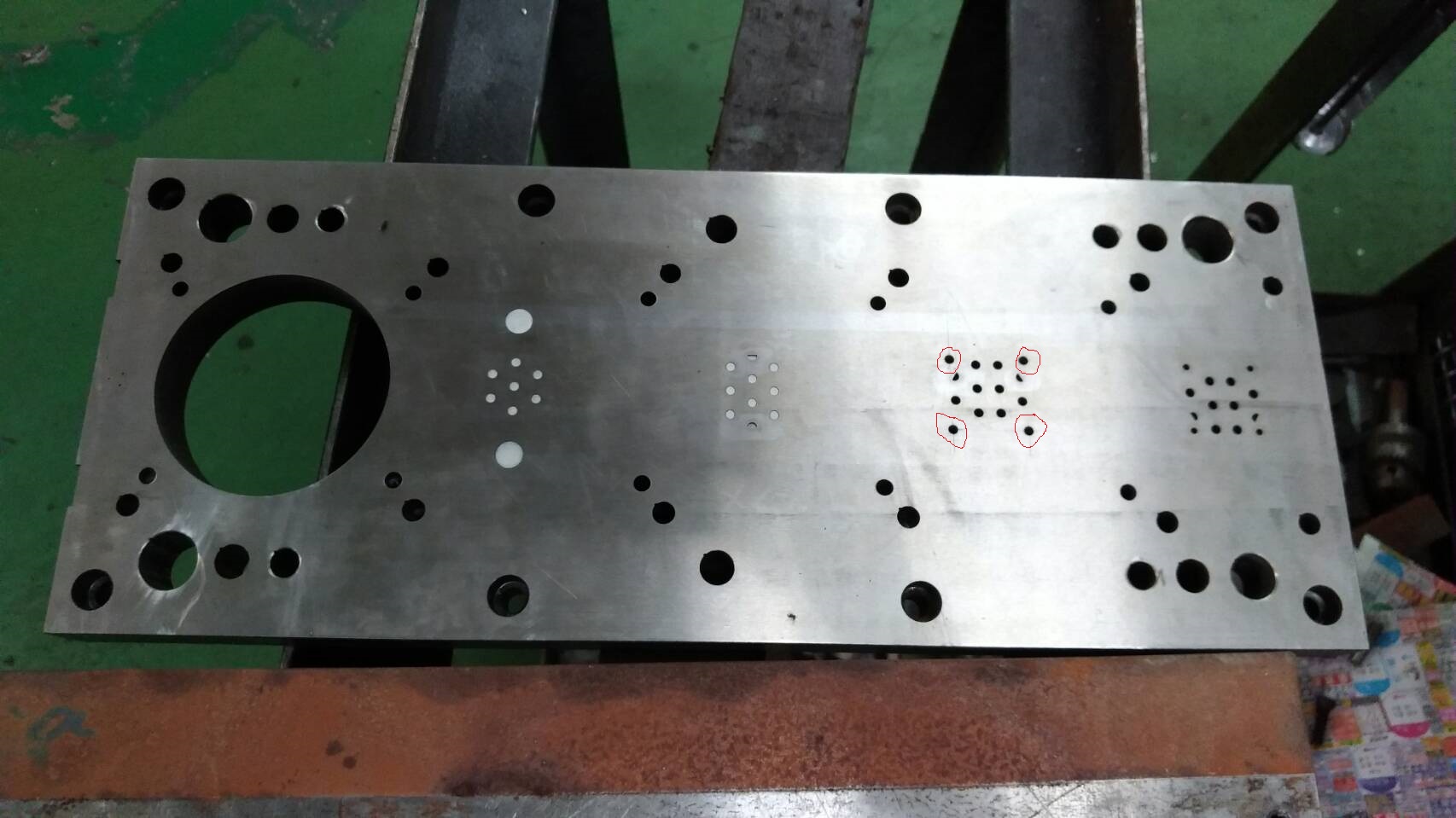

I can’t stress how unusual this is; it’s simply not how things are done. Most consumer electronics rely intensely on the supply chains of the Pearl River Delta - the same places where our speaker, battery clips, knob, and potentiometer (and likely a number of other tertiary components) are made. They’re made in batches between 10,000 and a million, and are then containerized and shipped to large fulfillment centers in places like Pennsylvania’s Lehigh Valley and Chino, CA. There they sit, sealed in their retail packaging until someone places an order. And when that happens, a relatively low-skilled worker picks it off a shelf and puts it in a box.

As appealing as this may sound, it isn’t a realistic option for The Public Radio. TPR is customized to one of about 300 possible FM frequencies, and unless we were willing to purchase a huge stock of pre-programmed radios (with more of the popular frequencies, just like T-shirt makers buy more medium and large sizes than XXXL) it just wasn’t practical to assemble it in China. A few proposals that we considered:

Assemble un-programmed radios in China, put them in boxes, and ship them to the US; then use a contactless programming method to program the FM frequency at a US fulfillment center. This isn’t crazy, and Josh created a pretty impressive technical demonstration. But finding a fulfillment partner was problematic, and switching to this process would effectively prohibit us from doing the laser marking that our radio station customers love so much.

Do partial assembly in China (mechanical assemblies only - no jars or boxes) and do the rest in the US. Similar to #1, finding a fulfillment house was an issue - and the laser marking would have been tricky as well. Additionally, we’d be stuck using expensive US-made mason jars, keeping our COGS high while requiring a bunch of additional work on our part.

Just add a tuning knob, turning the product from “a single channel radio in a mason jar” to “a mason jar radio.” This is a fair suggestion, but one that (for philosophical reasons) didn’t make sense for us.

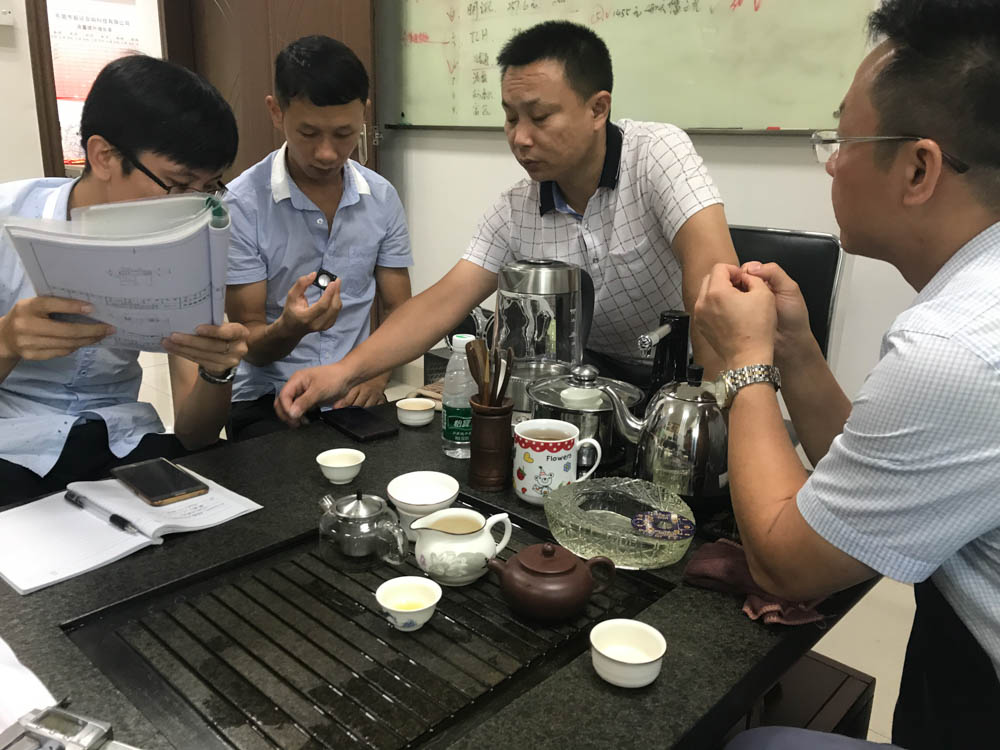

In summary, The Public Radio is a relatively rare example of a consumer electronics product whose supply chain relies heavily on the greater Shenzhen ecosystem but then is assembled and fulfilled completely from the US. We’re proud of this fact, but have been pragmatic (as opposed to idealistic) about how our supply chain operates. So with that in mind: How exactly does The Public Radio end up as a $60 product?

Where the money goes

So, here are the big takeaways:

Our cost of goods sold has varied a little over the past year, but it’s currently around $18.54.

75% of our cost of goods sold goes to US vendors, and the majority of that stays in the US.

About 50% of our cost of goods sold goes towards assembly labor. Part of this is automated (pick and place PCBA) but more than half is hand assembly.

The two most expensive components in our BOM are:

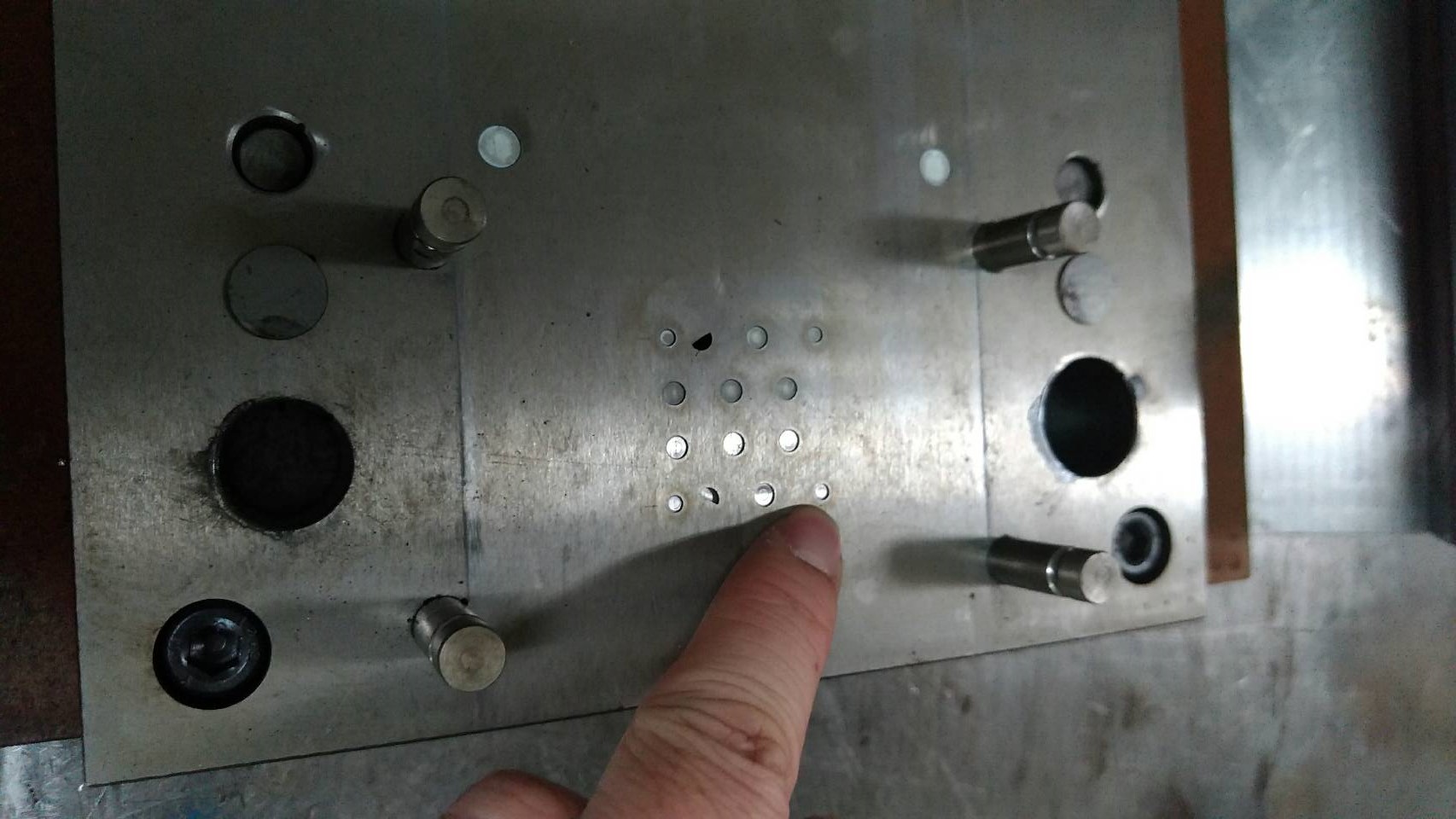

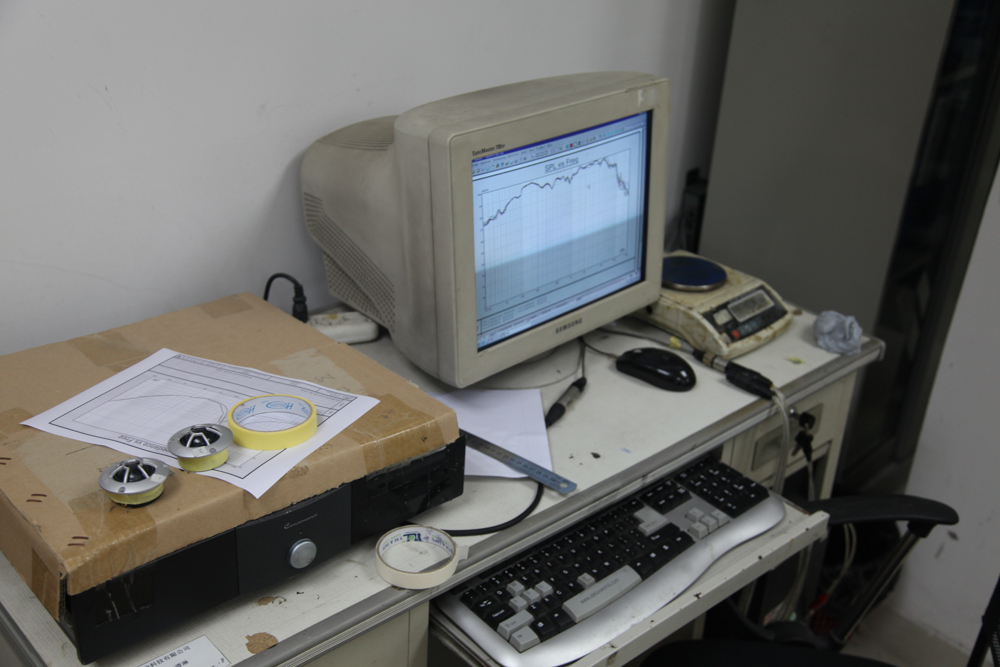

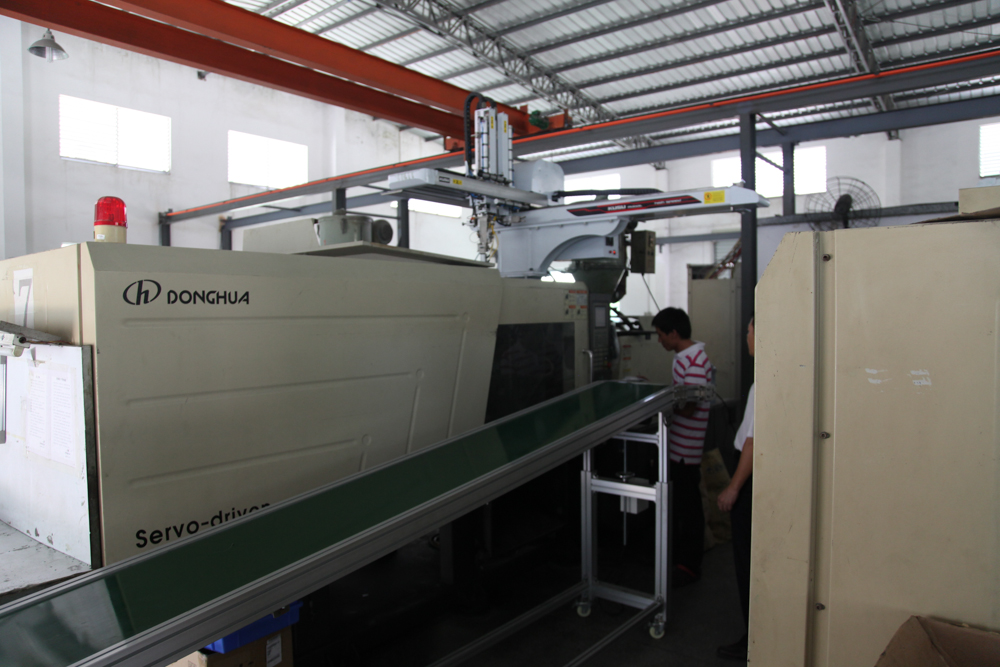

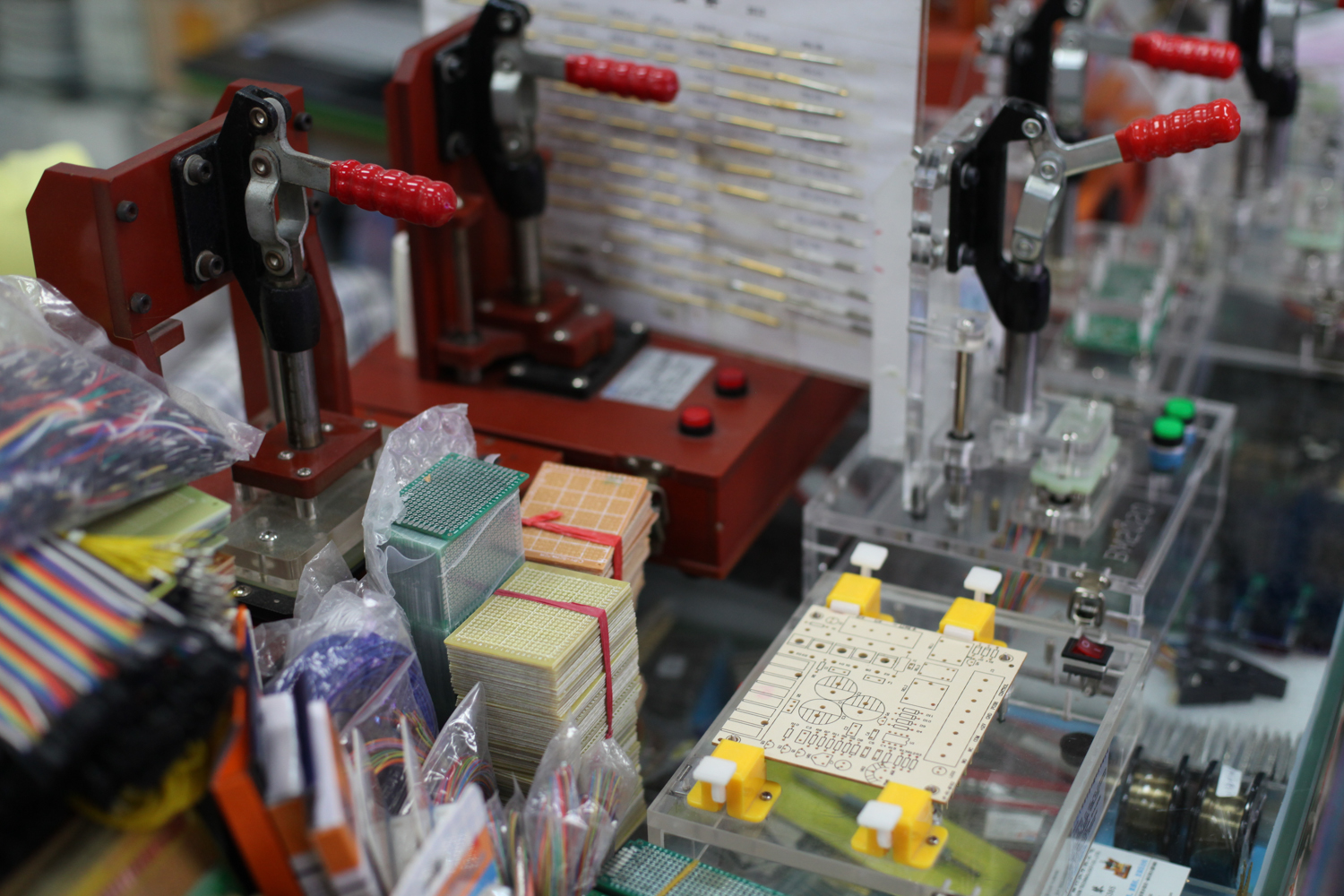

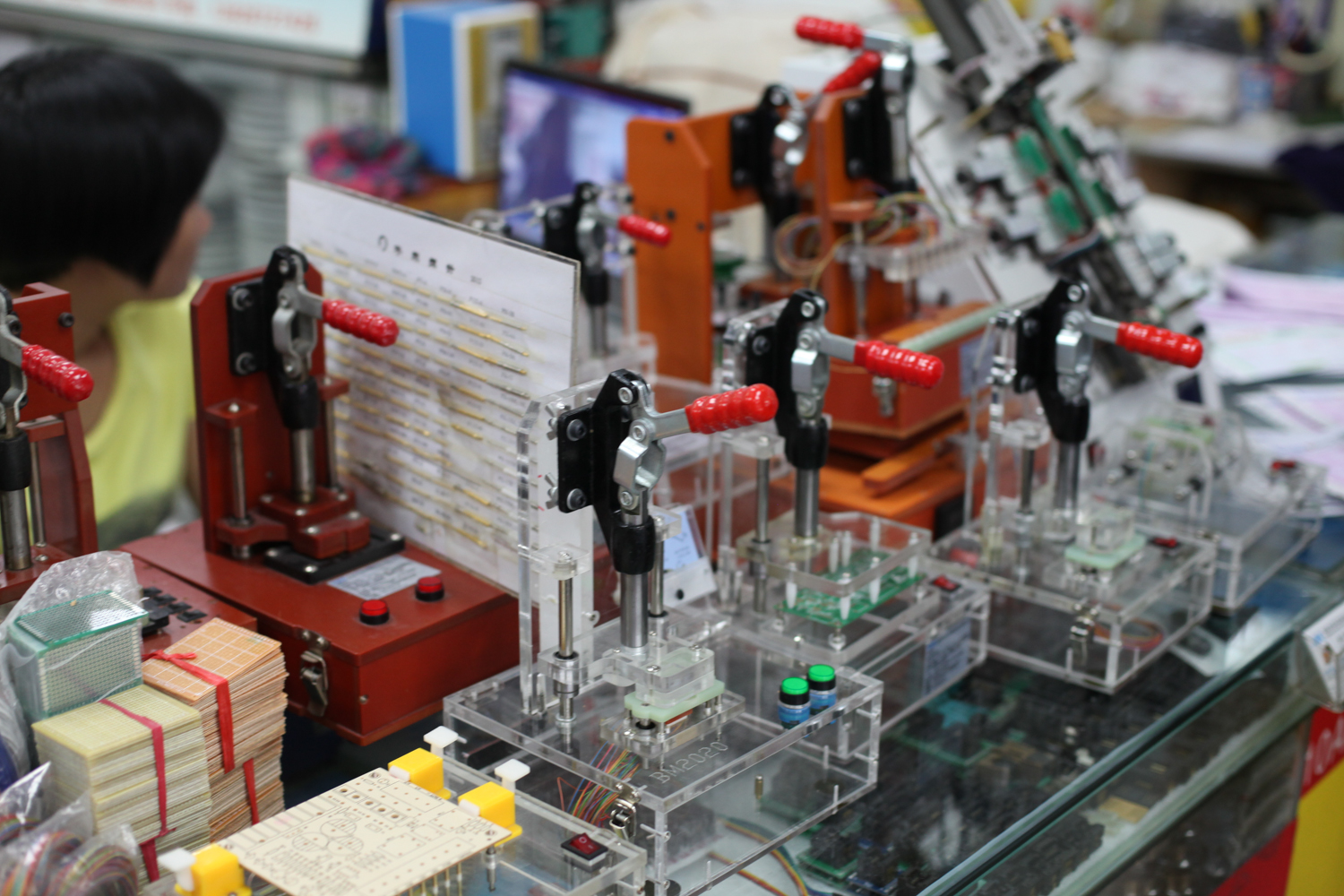

Our speaker, at $2.35/ea, accounts for 12.68% of our COGS. This is manufactured in Dongguan (see here for photos of the facility) and is custom for us.

Our FM receiver module, at $1.53/ea, accounts for 8.26% of our COGS. This is a standard component from Silicon Labs, and I’m told that its claim to fame is that it was part of the original iPod Nano. This is probably the first component on our list to replace, as there are certainly less expensive chips options with all the options we’d need.

The broader story is that at our scale (5-10,000 units per year), consumer electronics is expensive. Purchases at that level simply don’t bring much leverage, and our just-in-time production model ends up being expensive on a per-minute basis (partly due to switching costs).

Here are the raw(er) numbers:

COGS by vendor location

How you sell a product with an $18 COGS

Back in 2014, we sold our first few units for $45 direct to consumers. Our first Kickstarter sold radios for $48/ea with shipping (about $5 our cost) included. In our second Kickstarter, we dropped the price to $39/ea and then charged shipping separately.

In mid 2017 we got our first retail account and listed The Public Radio for $45/ea. We set up drop shipping terms with a wholesale price of $33.75, a price that was intended to give equal margins to us and our retailers.

Sadly for us, this arrangement failed to gain traction. We got about as many 2017 holiday orders as we had hoped for (and about as many as we could have handled; see here for more history, including the ~1000 radios that I personally assembled and shipped from my basement on nights & weekends), but per the section above it became evident that we would need to increase our volumes significantly to make the numbers work out at a $45 price point. And while we maintain 4.9 star reviews on Uncommon Goods, the process of signing up large drop-ship accounts is simply a new skill, and one that hasn’t so far aligned well with our operating model.

So, we increased our prices. On the one hand this sounds crazy - we had a relatively successful product that we wanted to sell more of; the typical answer to that scenario is probably not to charge more for it. But the price increase allowed us to offer keystone pricing to brick-and-mortar retailers, and it gave drop-ship retailers significantly more margin to play with - making us a better partner for them as well.

In the meantime, we doubled down on direct-to-consumer sales. This also is a new skill, but I’m happy to say that since our price increase, we’ve managed to more than double both our direct-to-consumer revenue and our direct-to-consumer sales volume; in other words, we’re selling more units and making more money off of each sale.

Looking ahead

Every time I look back at The Public Radio, I marvel at just how much work has gone into it. It now runs as a well oiled machine; we’ve invested heavily in order processing & inventory management automation, and have structured our vendor & customer relationships in ways that allow us to produce a piece of consumer electronics as a side job. And in spite of (or perhaps because of) a fair dose of uncertainty early in 2018, it’s now clear that this will be a profitable year for us.

But there’s still a lot of work to be done, and I continue to wonder whether there are fundamental changes we could make to allow our US based supply chain to thrive even more. I’m lucky to have been able to explore this kind of manufacturing as much as I have thus far; I look forward to more of it in the next year.